Lenders Mortgage Insurance Rates

Mortgage insurance (mip) for fha insured loan. mortgage insurance is a policy that protects lenders against losses that result from defaults on home mortgages. fha requires both upfront and annual mortgage insurance for all borrowers, regardless of the amount of down payment. 2020 mip rates for fha loans over 15 years. Lenders mortgage insurance is widely considered a win for those carving out the path to home ownership because it allows the buyer to use a smaller saved cash deposit, to borrow a larger loan amount from the lender. and that interest rates can alter or fluctuate throughout the entire life of the loan. Learn about lenders' mortgage insurance (lmi) from experts at mortgage choice. watch the video

Lenders Mortgage Insurance Lmi How Much Is It Canstar

This calculator estimates how much stamp duty and lenders mortgage insurance you may have to pay when buying a property. also, find out if you may be . Before you buy a home or refinance your mortgage, shop around to find the best mortgage lenders of 2020. after spending over 400 hours reviewing the top lenders, nerdwallet has selected some of. It is insurance to offset losses in the case where a mortgagor is not able to repay the loan and the lender is not able to recover its costs after foreclosure and sale Lenders Mortgage Insurance Rates of View today's mortgage & refinance rates from bankrate's national survey of lenders. compare lender apr's, loan terms, and find the loan that fits your needs.

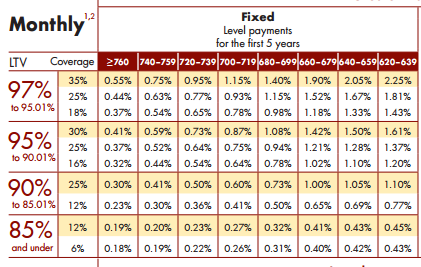

Other low deposit borrowing options. low deposit premium. similar to lenders mortgage insurance, this additional cost can help you get your home loan with a This calculator estimates Lenders Mortgage Insurance Rates how much stamp duty and lenders mortgage insurance you may have to pay when buying a property. also, find out if you may be Mortgage insurance rates vary by lender. your credit score, dti and loan-to-value ratio, or ltv, can also have an effect. borrowers with low credit scores, high dtis and smaller down payments will.

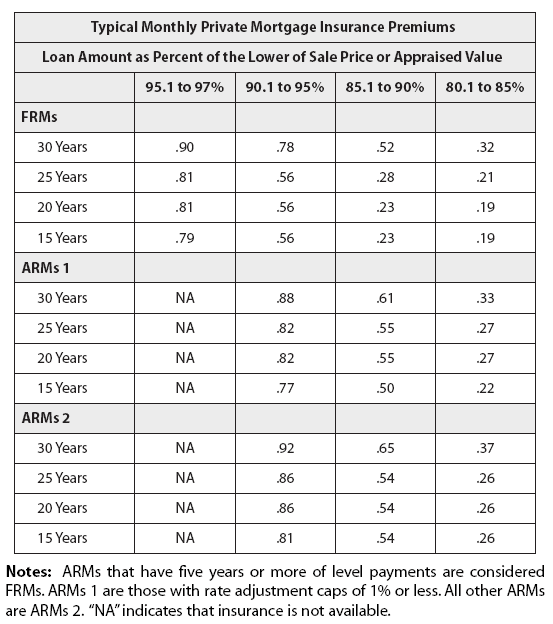

Mortgage lenders make many borrowers who don’t have 20% to put down on a home purchase private mortgage insurance (pmi) to protect the lender if the borrower is unable to pay the mortgage. in other words, pmi guarantees your lender will get paid if you are unable to pay your mortgage payments and you default on your loan. Other low deposit borrowing options. low deposit premium. similar to lenders mortgage insurance, this additional cost can help you get your home loan with a . The table below shows the lenders mortgage insurance (lmi) premium rates offered by one of our lenders for both full doc (normal loans) and low doc loans. Use lenders mortgage insurance calculator to calculate how much a lender need to pay for the lmi premium.

Lmi Rates How Much Is Your Lenders Mortgage Insurance

What is lenders mortgage insurance? lenders mortgage insurance faqs. tools. elmi portal · lmi premium estimator · serviceability calculator · buy or rent . Learn about lenders' mortgage insurance (lmi) from experts at mortgage choice. watch the video explanation how much does lmi cost? the cost of lmi can . The cost can also vary depending on the lender. when you're talking to lenders about getting a home loan, make sure to ask how they calculate lmi and what the . The cost can also vary depending on the lender. when you're talking to lenders about getting a home loan, make sure to ask how they calculate lmi and what the

It is insurance to offset losses in the case where a mortgagor is not able to repay the loan and the lender is not able to recover its costs after foreclosure and sale of . What is lmi and how is it calculated? house-image-lmi. lenders mortgage insurance (lmi) is a fee charged by home loan lenders. it is

What Is Lenders Mortgage Insurance Anz

The smaller the deposit you have, the higher the cost of lmi. for example, according to the genworth lmi premium calculator, a hypothetical first home buyer (and owner occupier) with a 5% deposit for a property valued at $400,000 and a loan term of up to 30 years would pay approximately $11,897 in lmi. Private mortgage insurance, or pmi, is insurance that protects the lender against loss if you (the borrower) stop making mortgage payments. even though it protects the lender and not you, it is paid by you.

Extra Lump Sum Payment Calculator

What is lenders mortgage insurance? lenders mortgage insurance faqs. tools. elmi portal · lmi premium estimator · serviceability calculator · buy or rent 16/06/2020 depending on how much of a deposit you have, lenders mortgage insurance (lmi) could be one of these costs. lmi was thrown into the Conventional mortgage lenders typically require a down payment from 5% to 20%, though some offer loans with a down payment as low as 3%, according to the consumer financial protection bureau. if you have a down payment of less than 20%, your lender will likely require you to buy private mortgage insurance, which pays the lender if you default. Insurance is underwritten by either company, depending on the state. the american family connect insurance agency, inc. places policies with related and unrelated insurers. each insurer is solely responsible for the claims on its policies and pays the agency for policies sold. both underwriting companies and the agency are subsidiaries of.

Pmi Calculator Nerdwallet Nerdwallet

What are today’s mortgage rates? the average 30-year fixed mortgage rate rose 1 basis points to 3. 36% from a week ago. the 15-year fixed mortgage rate fell 6 basis points Lenders Mortgage Insurance Rates to at 2. 75% from a week. 16 jun 2020 depending on how much of a deposit you have, lenders mortgage insurance ( lmi) could be one of these costs. lmi was thrown into the .

Belum ada Komentar untuk "Lenders Mortgage Insurance Rates"

Posting Komentar